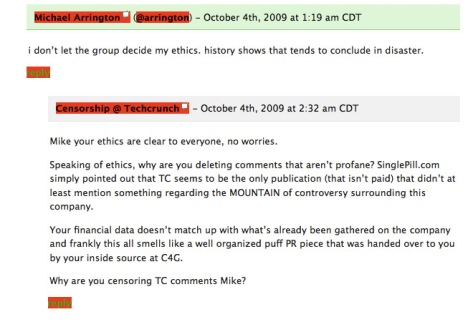

Mike Arrington of Techcrunch recently profiled C4G on his influential blog. He stated that according to an inside source;

“It’s more than surprising that the company raked in $90 million in revenue in the first year of operations according to a source close to the company. Profit, even after paying out cash to sellers and a huge marketing spend, was in the $30 million range. Revenues in 2009 are on track to hit $160 million, says our source, with a similar profit margin. That implies $50 million or so in 2009 profits.”

Wow, that’s a lot of smelted gold. In case you’ve been living under a rock, didn’t watch the SuperBowl or aren’t in dire straights financially C4G according to it’s CEO and founder Jeff Aronson is a “disruptive company”. Which essentially gives consumers the ability to sell unwanted jewelry direct from their home. No more traveling to the local pawn shop in that nasty part of town. C4G has been under a lot of scrutiny (although none of which is mentioned in Arrington’s article) for their business practices. There have been many claims from postings by alleged former employees, ripped off consumers and even Consumer Reports.

This is directly from the consumer reports investigation;

Consumer Reports, using its “mystery shopper” team, sent 24 identical gold pendants and chains (purchased for $175 each) to Cash4Gold.com and its competitors. The determined melt value of the jewelry was calculated at around $70 each when gold was above $900 an ounce. In comparison with pawn shop and Jewelry store quotes (which ranged from $25 to $50), Cash4Gold.com quoted between $7.60~$12.72 melt value for the jewelry. Similar low quotes were also given by Cash4Gold.com competitors GoldKit (around $7.81~$20.59) and GoldPaq (around $8.22~$13.11).

Other accounts on the internet only seem to further speculate that consumers will receive the least for their gold when doing business with C4G. There have also been accounts by alleged former employees whom have said that the call center is run in a very boiler room type fashion. The customer service reps receive bonuses based on how little they can get a consumer to agree to accept for their gold.

In Arrington’s profile on Techcrunch he states that 2009 revenue is on track for $160 million. Wikipedia states that C4G is selling 3,000 to 4,000 ounces of gold each week. While Bloomberg media (with information provided by C4G) stated that they “typically sell 6,000 ounces of gold a week”. The current “spot price” for gold is right around $1,000 per ounce. So that means that C4G is pulling in $6 million a week in sales. Based on Techcrunch’s insider information that should net them almost $2 million a week or well over $100 million in profits by years end. Wow.

Hey if you’re a little nervous about sinking money back into the market, Aronson has the gold smelted into 1000 ounce bars (which weigh about 63lbs) which would be easy to bury in the back yard or hide in a secure safe. Just be ready to cut a check for a cool million.

So what’s up with the huge difference in Arrington’s numbers and ours? Why would C4G give him such paltry figures for publication? Especially for a company that just took on VC money from Mangrove Capital Partners. One can only speculate.

It’s pretty easy to calculate that if not for C4G paying out (based on the Consumer Reports data) 10 to 15% of the spot price of the gold they wouldn’t be so profitable. Their overhead employing 350+ people, call center and smelting facilities doesn’t come cheap. However I feel that their marketing costs must take the largest bite out of their operating budget. C4G only advertises on TV, from late night infomercial type spots to SuperBowl ads featuring cash strapped celebrities. There’s some huge advantages in trying to acquire your clients via “infomercial” style ads, statistically those consumers are less likely to purchase items via the internet.

Well so what? Well if one were to see an ad on the internet for C4G you might be inclined to read up on them to see if they’re legit. As of this posting if you Google “Cash 4 Gold” five out of the first ten results essentially call their operation a RIP OFF. The rest of the remaining spots (excluding the #1 spot) are taken by their competitors. It might be a little more difficult to convert that prospective web based lead into a sale. Having them call the 800 number for their “refiners return pak” is a much better alternative.

An interesting aside C4G has a direct competitor, Cash For Gold (United Jewelry Buyers) which no doubt is reaping the rewards of Cash 4 Gold’s aggressive marketing.

It remains to be seen if this company can withstand the storm of negative PR. There will always be desperate people who fall for good marketing but I think that this company has a limited shelf life, certainly if they don’t begin to “refine” their image. I asked a dozen people what they know about Cash 4 Gold and all of them essentially said it’s a rip off operation. That kind of bad PR will eventually cut their margins lower and lower. No matter how many television ads you run you won’t be able to outrun your reputation.

If I were Aronson I’d start stocking away some of those gold bars soon, if he hasn’t already.

UPDATE!

We just discovered a press release from C4G in which they’re offering Terry Herbert who discovered 1,500 pieces of gold, weighing a total of 16 lbs $164,000! Wow, that translates to about 62% of market spot price. Hey why not just make 50% of spot price your locked in rate for all transactions. Press Release

Filed under: Uncategorized | Tagged: cash 4 gold, cash for gold, gold scams, michael arrington, mike arrington, rip offs, sell gold, techcrunch | Leave a comment »